Improving Cash Flow with Open Banking for Checkouts

by Gosia Furmanik on March 16, 2022

SMEs play a considerable role within the British economy, but 20% fail within the first year of establishment. The primary culprit for these businesses failing is inadequate cash flow.

According to the latest global research project, “The State of Small Business Cash Flow”, 57% of companies this size experience problems within this financial area. It’s a significant problem for SMEs because there isn’t endless capital to play around with.

The problem with cash flow issues is that they can stem from various situations. For example, it could appear from poor invoice management, long payment transaction times, or insufficient forecasting in vital business areas. Don’t believe us? Let’s take a further look into the statistics:

Unpaid invoices increased by 41% during the pandemic

SMEs spend a total of 56.4 million hours looking for overdue payments

Credit card payments take between 24 and 72 hours to process into a merchant account

65% of SMEs don’t have a business plan or financial forecasts in place

The average amount owed per invoice is £8,500

Combining the data above gives a clear indication of why SMEs are struggling with cash flow. However, since Open Banking, managing, controlling, and forecasting this crucial business aspect has never been easier. To develop a further understanding of this and other tips that’ll boost cash flow, we recommend becoming knowledgeable on the following:

5 Tips to Improve Cash flow for eCommerce

As discovered, cash flow plays a substantial role within the business world. Failing to have sufficient spendable funds can quickly limit growth or, even worse, force you into bankruptcy. It’s a situation that all SMEs want to avoid, so here’s how you can restrict the possibilities.

Add Open Banking payments to your eCommerce checkout

The phrase “Cash is King” is undoubtedly correct for a business’s longevity. Therefore, shortening payment times will certainly help by enabling you faster access to essential funds.

Above, we mentioned that traditional credit card payments take 24 to 72 hours to process. It’s a considerable amount of time; shortening this could be the difference between cash flow problems and not.

That’s where Open Banking showcases advantages because it allows you to exchange data with third-party financial services safely and securely. With this, you can connect our eCommerce Open Banking checkout plugin to your online store.

By effortlessly using our Plug’n’Play product and inputting it onto your eCommerce checkout, you’ll begin to receive customer payments instantaneously. Now, instead of waiting 24 to 74 hours for funds, they’ll get deposited into a merchant account straight away.

Undeniably, the benefits obtainable from implementing this plugin are evident. However, for a clearer understanding of how it’ll improve cash flow, see below:

Funds are deposited into a merchant quicker, allowing for optimal cash flow

The reduction in processing time allows for sustainable cash flow forecasting

Instant payment requires fewer financial resources, improving business efficiency

SMEs should be considering an Open Banking payment system on their eCommerce store. Having instant access to funds eliminates most cash flow problems; allowing businesses to focus on what matters, growth.

Use balance reports or cash flow projections!

In addition, utilising either balance reports or cash flow projections could be beneficial. Each follows a similar concept, but they have different methodologies. For instance:

Balance reports –

Outline the company’s assets, liabilities, shareholders’ equity, and more to determine a business’s proper “balance” or funds.Cash flow projection –

These are a more straightforward breakdown than balance reports, as it’s a statement that shows the inflows and outflows of transactions over a given period.

Whichever you choose will provide you with a more comprehensive overview of the business’s cash flow. With this data, you can manage and forecast funds more effortlessly; limiting problems related to spendable cash.

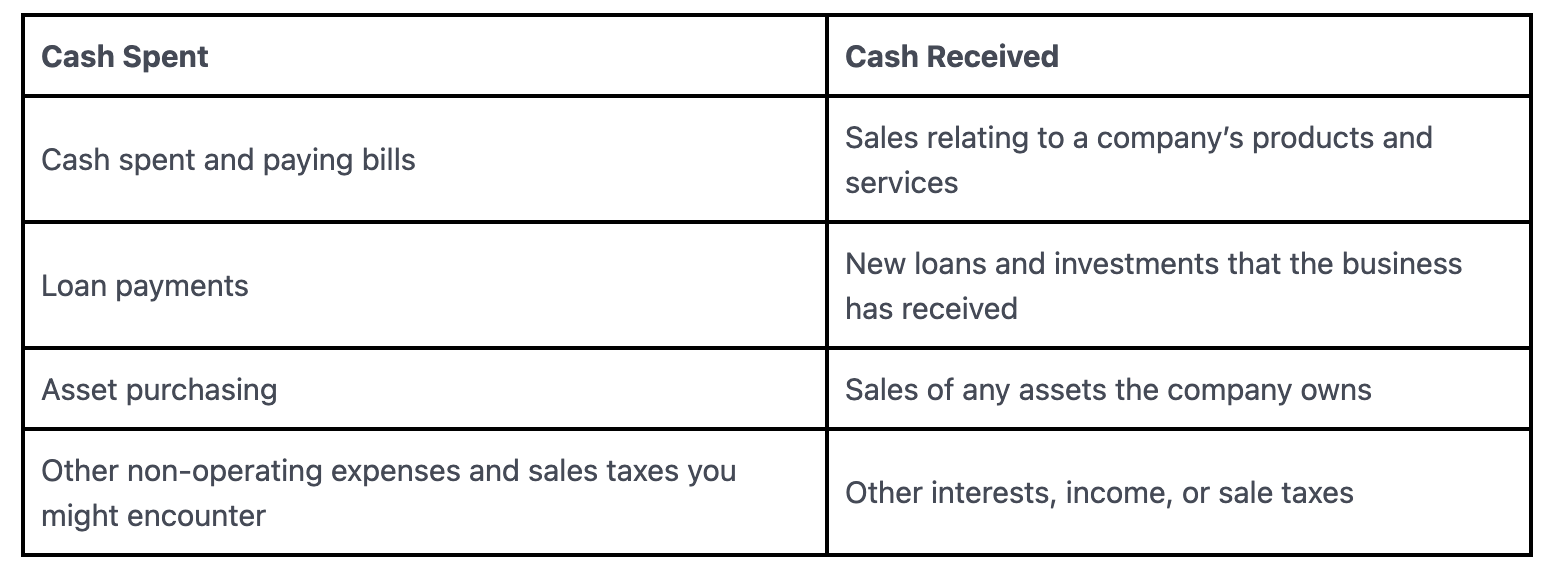

When developing either a balance report or cash flow projection, you’ll need to account for the cash received and spent. Undoubtedly, what these are will fluctuate massively and highly depend on the company’s operations. However, tracking the following is an excellent foundation for either method:

Tracking, managing, and forecasting cash flow through either of these methods is essential. By achieving this successfully, it’s possible to identify upcoming cash gaps, spot cash flow surpluses, and limit problems related to funds.

When forecasting or reporting income and outgoings, shorter projections work best. Therefore, Open Banking can once again help by improving the transaction speeds exceptionally, allowing for more accurate predictions with cash flow.

Align expenses with the revenue pattern

Including the above, discovering revenue patterns and aligning expenses according to this could also improve cash flow. But what do we mean by this?

When businesses enter their emergency fund, it isn’t an ideal situation. One of the most effective ways of limiting this occurrence is by successfully aligning significant expenses with revenue. For example, let’s say a vendor requires a substantial payment 60 to 90 days after the product or service has been delivered. In that event, trying to forecast cash flow and align it with this expense will reduce the impact received against a company’s funds.

Implementing this can offer an array of cash flow-related benefits, such as:

Improved cash allocation –

Aligning considerably-sized expenses with an adequate cash flow forecast will allow for more precise allocations and limit the chances of any issues occurring.Effective cash management –

By employing this strategy in your business’s practices, it’ll promote an overall more effective cash management plan.Enhanced budgeting –

It also optimises budgeting by clearly showcasing how and when certain expenses are required.

It’s a business aspect which Open Banking can once again provide advantages. By utilising this, you can receive payments seamlessly and better understand the company’s incomings and outgoings. Therefore, it makes the entire alignment process more straightforward, allowing you to offset expenses with expected revenue patterns.

Clear out your inventory

Another general restriction to cash flow with SMEs is inventory. Undeniably, it’s considerably important to guarantee that your cash isn’t held up in a significant amount of stock.

Falling into cash flow hardship over slow-moving stock isn’t an ideal situation. Therefore, it’s essential to clear slow goods and have a steady sales flow. When encountering this, it’s more expensive than you might think, as it’ll cost the following:

Product depreciation

Storage costs

Handling costs

Other administrative expenses

Because of this, you should clear them fast (at a discounted rate) and develop a solidified stock management plan. By selling them, you’ll obtain some lost cash flow; however, you don’t want to be confronted with this again. Therefore, creating an adequate inventory forecasting formula is necessary.

Now, there are various approaches to this, neither being remarkably complicated. But, the following method is commonly practised by many SMEs, which looks like:

Calculate lead time and demand

(average lead time in days x average daily sales)

Measure sales trends (either micro or macro), which is the increase and decrease in sales over a set period

Setup a reorder point or note

(average daily sales x lead time + safety stock)

Calculate safety stock

(maximum daily sales x maximum lead time)

–(average daily sales x average lead time in days)

Once you’ve figured out the above, you’ll limit the chances of encountering dead stock and reducing cash flow.

Optimise invoice management

Lastly, optimising invoice management can also reduce the possibility of cash flow problems. After reading this entire post, you should be aware that payments have a considerable impact on this issue. With unpaid invoices reaching an all-time high, limiting friction during this process is mandatory.

For those unaware, invoice management is a business function primarily linked to procurement and is accountable for managing/processing documents for vendors, suppliers, or clients. Having an adequate management plan centred around this allows you to maintain accurate cash flow forecasting and manage funds adequately.

At Fena, we’ve developed a new, innovative way of restricting payment friction and making procurements more effective. The tool we’re suggesting is our QR code invoice payment feature, which enables users to automatically transfer funds through a payment link attached to a QR code.

It can be attached to an invoice (via print or email) and can eliminate an enormous amount of friction usually seen when paying invoices. Instead of clients having to write a cheque, type in banking information, etc., they’ll be re-directed to a payment URL that could have their details saved, making payment immensely fast.

Conclusion

After reading the above, you should have a complete comprehensive idea on improving cash flow with Open Banking for eCommerce. Unquestionably, this technology has enabled us to take payments faster, gain access to more financial data, and opened the world of economic-based tools. For more information about what Open Banking products Fena offers, click here.