[TEMPLATE] Line Sheet Template for your Wholesale Products

[TEMPLATE] Line Sheet Template for your Wholesale Products

Trade Show Checklist for Wholesalers & Manufacturers: 15 Steps to Success

By following this checklist, you can maximise their trade show participation, connect with potential customers, and generate valuable leads that drive business growth.

Pricing your products for wholesale is a crucial step in expanding your business and reaching a wider customer base.

8 Tips to Get Your Stockists to Order Online: Streamlining Wholesale for Everyone

Transitioning your stockists from traditional ordering methods (like phone calls or emails) to your online wholesale platform can be a game-changer.

Mastering Inventory Management for B2B and B2C Sales: A Guide for Growing Brands

Selling both B2B and B2C requires a nuanced approach to inventory management. Each channel has different order volumes, lead times, and customer expectations.

A well-structured SKU system can save you time, minimise errors, and provide valuable insights into your product performance.

Pricing strategy for wholesale: Maximising Profit and Competitive Edge

As a wholesaler, your pricing model directly impacts your bottom line, customer relationships, and overall market position.

In an era dominated by ecommerce, business owners find themselves in the intricate web of scaling operations while striving to keep their ecological footprint to a minimum.

In an era where ecommerce is steadily evolving, ensuring seamless transactions and operational fluidity from checkout to delivery becomes paramount for businesses, especially for Small and Medium Enterprises (SMEs).

In an era where customer expectations are skyrocketing, small and medium-sized businesses (SMBs) must be quick, precise, and wholly customer-centric in their operations.

In the booming era of eCommerce, small and medium-sized enterprises (SMEs) seek innovative solutions to combat the multifaceted challenges of selling furniture online.

The Future of Furniture Shopping: A Virtual Reality Experience

Navigating through the digital transformation, the ecommerce sphere, especially in the furniture industry, has been incessantly exploring innovative pathways to elevate customer experience.

In the rapidly evolving world of ecommerce, the focus often lands heavily on acquisition: more traffic, more clicks, more sales.

In today's fast-paced ecommerce landscape, one of the challenges that small and medium businesses (SMBs) face is managing customer interactions efficiently.

In today's fast-paced digital world, the ecommerce industry has witnessed a dynamic shift in how business is done.

The ecommerce landscape has witnessed exponential growth in the last two decades, reshaping the way businesses connect with their consumers.

With the dynamic surge of mobile shopping, small and medium-sized enterprises (SMEs) find themselves on a transformative journey, enhancing not only the way they operate but also how they interact with their customers.

As we tread through the progressive digital era, ecommerce has impeccably moulded retail behaviours, bringing the convenience of shopping right to consumers' fingertips.

How Proper Inventory Management Boosts Your Business’s Efficiency

In the bustling world of ecommerce, efficiency is the kingpin that drives business growth and sustains competitive edges.

Maximising Profits with Smart Inventory Reduction Techniques

In the ever-evolving landscape of ecommerce, small and medium business owners constantly seek efficient ways to manage their operations and boost profitability.

Avoiding Stock Outs: Strategies for Effective Inventory Control

In the dynamic landscape of ecommerce, ensuring that products are always available for your valued customers is paramount.

5 Innovative Inventory Management Techniques for Online Stores

Effective inventory management not only ensures that orders are fulfilled in a timely manner but also aids in optimising storage costs and enhancing customer satisfaction.

In this video, we explore Account Information Services (AIS), a key aspect of the Open Banking revolution.

[VLOG] Open Banking for eCommerce - presented by Fena's cofounder Gosia Furmanik

In this video, Fena's co-founder Gosia Furmanik, an expert in the fintech sector, demystifies Open Banking Payments and its advantages for ecommerce businesses.

[VLOG] Open Banking for Wholesalers brought to you by Fena's cofounder Gosia Furmanik

Join us in this video where Fena's co-founder, Gosia Furmanik, unravels the complex world of Open Banking payments, specifically for wholesalers.

[VLOG] Open banking for B2B payments - presented by Fena's cofounder Gosia Furmanik

Gain an in-depth understanding of the key benefits of Open Banking, such as enhanced transparency, streamlined operations, and improved security, and learn how they play a crucial role in B2B transactions.

Bulk payments are transforming the way businesses handle their finances, offering greater efficiency and accuracy, and Open Banking is propelling this evolution.

[VLOG] Fena's Open Banking Recurring Payments explained [SHORT]

Learn how recurring payments like subscriptions or rent work when collected using Open Banking standing orders.

[VLOG] A short history of Open Banking presented by Fena's cofounder Gosia Furmanik

Join us in this enlightening video as we journey through the history of Open Banking in the UK and Europe, featuring the co-founder of Fena, Gosia Furmanik.

Scaling an ecommerce business requires strategic planning and seamless execution.

10 tips for streamlining your ecommerce operations & payments

In this post, we share some tips aimed to streamline payment collections, cut costs, boost productivity, and select the appropriate software for multichannel sales and inventory management.

From B2C to B2B and back: How to handle different types of customers

In this post, we will delve into the world of B2B and B2C sales, exploring the unique characteristics and behaviours of customers in each domain.

The ecommerce economy has been growing rapidly in the UK and the EU in recent years, driven by factors such as changing consumer behaviour, technological advancements, and the COVID-19 pandemic.

With the proliferation of digital technologies and the growing preference for online shopping, businesses are increasingly embracing technology to enhance their operations and stay ahead of the curve.

In this article, we will look at some of the key ways in which technology is helping ecommerce businesses to grow in the UK, with a focus on marketing tech, paytech, fintech, logistics and automation.

Fena, a leading provider of Open Banking payment solutions (https://fena.co), and DMS Navigator, a top dealer management system provider (https://www.dmsnavigator.com/), are excited to announce a strategic partnership that will transform the way payments are processed in the automotive industry.

This report delves into the changing dynamics of B2B buying behaviour, highlighting the key drivers of change and providing examples of firms that have adapted to these new trends.

What factors to consider when looking for payments for your ecommerce store?

When launching an ecommerce store, one of the most critical decisions you'll have to make is how customers will pay for their purchases.

As of January 2023, there are reportedly over 7 million active users of Open Banking in the UK, indicating a growing trend towards the adoption of this technology.

With the persistent inflation and rising costs of running a business, more and more wholesalers are looking to optimise their operational costs.

6 tips for SMEs to fight rising costs of running the business

SMEs face many challenges, including rising costs of doing business.

How to sell at events and farmers markets - The B2B and B2C edition

Events and farmer markets are great opportunities for businesses to showcase their products and attract new customers.

Open Banking payments are a new way of making and receiving payments for goods and services that allows individuals and businesses to securely move money between their bank accounts without exchanging any bank details

For banks, the CBD sector is seen as "high-risk", resulting in high fees and poor accessibility. To learn how open banking can help, see here.

5 Reasons to Add Account-to-Account Payments for WooCommerce

Open banking is the #1 solution for account-to-account payments on WooCommerce. Want instant settlement, low transaction fees, and secure payments? See here.

With the current inflation rates, running a business is becoming more difficult. To reduce this burden, read these 5 tips on how open banking can help.

Invoice payments are crucial to customer experience. For B2C customers, the customer experience is usually good, but for B2B it’s very different. To understand how you improve this, read here.

Open Banking has forever changed how we perform payment transactions. The wholesale industry can also benefit from the multitude of features. Here’s how.

Open Banking: How Accountants Can Improve Payment Collection

Are you an accountant that consistently doesn’t have enough time? Boost your efficiency with open banking. To find out how, read this comprehensive guide.

Topping up an investment account has never been easier with open banking payments. Read this to learn how to use open banking for investment apps.

Stay compliant with Open Banking: Everything You Need to Know

It hasn't been long since PSD2 got introduced. Read this post to understand the core requirements for open banking compliance. We detail everything from A-Z to guarantee compliance.

Since open banking was legally enforced in 2019, it’s changed how we can move money. To learn more about how it could help you, see here.

Over the phone payments are becoming more and more popular. Since the PSD2 was introduced, open banking has significantly changed the way we do this. Here’s why.

Latency problems when investing can be the difference between profitable and unprofitable trades. Avoid this by using open banking for investments; here's how.

The open banking benefits for accountants are unbelievable but not utilised enough. In this post, we detail bonuses accountants can receive from open banking.

Invoice payments can become difficult to reconcile in an accounts office without an adequate procedure. Open banking simplifies this process. Here's how.

If you own a second-hand car dealership and are looking for a smooth payment transaction option, open banking can help significantly. Here's how it can help.

Open banking for payments is an innovative way for businesses to trade goods and services without the need for traditional means like paper checks or bank transfers.

Open Banking Payments: How to Reduce Transaction Fees on eBay

Whether you're a one-off eBay seller or subscriber, you'll pay substantial payment processing fees. To discover how open banking payments can help, see here.

How Doctors and Dentists Can Take Advantage of Open Banking Payments

Are you a doctor or a dentist with your own practice? Then you're probably familiar with the high transaction fees and slow settlement. Open banking can help. Here's how.

The QR code is a symbol that was developed in Japan, and it has been used in various parts of the world for over 20 years.

SMEs play a considerable role within the British economy, but [20% fail within the first year](https://www.ictsd.org/what-percentage-of-businesses-fail-in-the-first-year-uk/) of establishment. The primary culprit for these businesses failing is inadequate cash flow.

The Benefits of Open Banking for Merchants Utilising SoftPOS

Contactless payments have become an increasingly popular method for paying for goods and services in the last few years, especially so in response to the COVID-19 pandemic.

Open banking is a rapidly emerging payment method for ecommerce.

A chargeback, unlike a refund, occurs when a customer requests their funds to be returned to them by filing a claim with their issuing bank or credit card company.

Paired with digital wallets, open banking payments provide a seamless way of moving money around and between accounts.

Pros and cons for account-to-account payments for ecommerce

Open banking promises to bring major, and beneficial, changes within the banking and payments ecosystem.

Open banking is a term that refers to the open access of banking services to regulated third parties via Application Programming Interfaces (APIs).

Recently, Amazon announced that they will stop accepting Visa Credit cards in the UK, with the change set to kick-in on 19th January 2022. But why is this?

Have you ever stopped to think about how card payments work and where the money goes?

Account-to-Account (A2A) payments are, quite simply, payments made by moving money directly from one bank account to another without any intermediaries.

It’s a new dawn, it’s a new world…. In the evolution of payments.

The legal and financial world are full of acronyms. And, PSD2 is one of them.

Our Invoice Request product has been updated with new features recently.

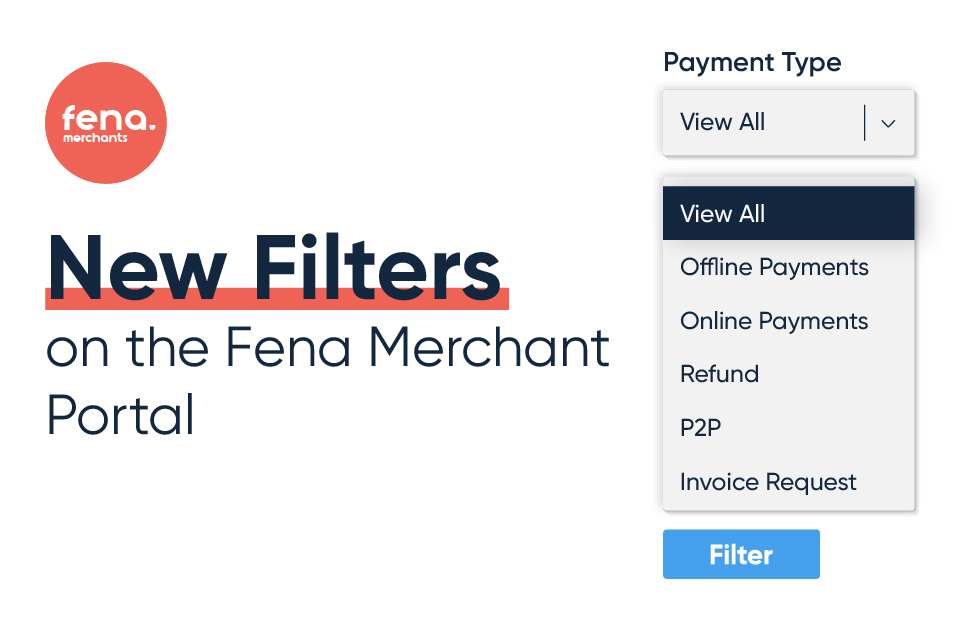

We released a new update to the Transactions tab on the Merchant portal.

When setting up your new integration or managing the existing one, you can now customise the background of the payment page, add your logo and change the colour button for the checkout button.

fena now offers a new feature for merchants.

Using Open Banking via fena, customers initiate a payment to a merchant or corporate using their mobile banking app or online banking webportal, in exactly the same way that they would pay with bank transfer.

How to connect an NFC card/QR code to your fena Merchant app

Your customers pay with the bank when they scan a QR code or tap on an NFC card.

After completing your registration for a fena Merchant account, you can start taking payments using the fena Merchant App.

fena's new look for the spring